Strategic Growth Framework

TOTAL ANNUAL GROWTH THROUGH THE CYCLE

LONG-TERM

FINANCIAL FRAMEWORK

- 35% core earnings conversion

- EPS growth > sales growth

- FCF conversion ~100%

- ROIC > 20%

- Target 2x leverage

Margin Expansion

| Margin Growth Drivers | Medium-term Range* | |

|---|---|---|

| Intelligent Devices |

|

22% - 24% |

| Software & Control |

|

31% - 34% |

| Lifecycle Services |

|

13% - 15% |

| Total ROK | Operational Excellence & Continuous Improvement | Price discipline | Accelerated top line growth |

|---|

*Targets introduced in 2023; Excludes impact of future acquisitions

Operationalizing Margin Expansion and Continuous Improvement

ROK Operating Model to drive margin expansion and productivity through FY26 and beyond

Incremental YOY Benefit

Key Levers for FY26 Productivity

| Enterprise Scale and Efficiency | Product Cost Reduction | Logistics | Insourcing/Vertical Integration | Manufacturing Efficiency |

|---|---|---|---|---|

| Lifecycle Services process efficiency | Direct material sourcing | Air to ocean | Plastic molding | Line optimization |

| Clearpath profitability | Product redesign | In region for region | Finished good sub-assemblies | Labor cost reduction |

| Functional productivity | ROK on ROK | Transportation Management System | Outside services | Quality improvement |

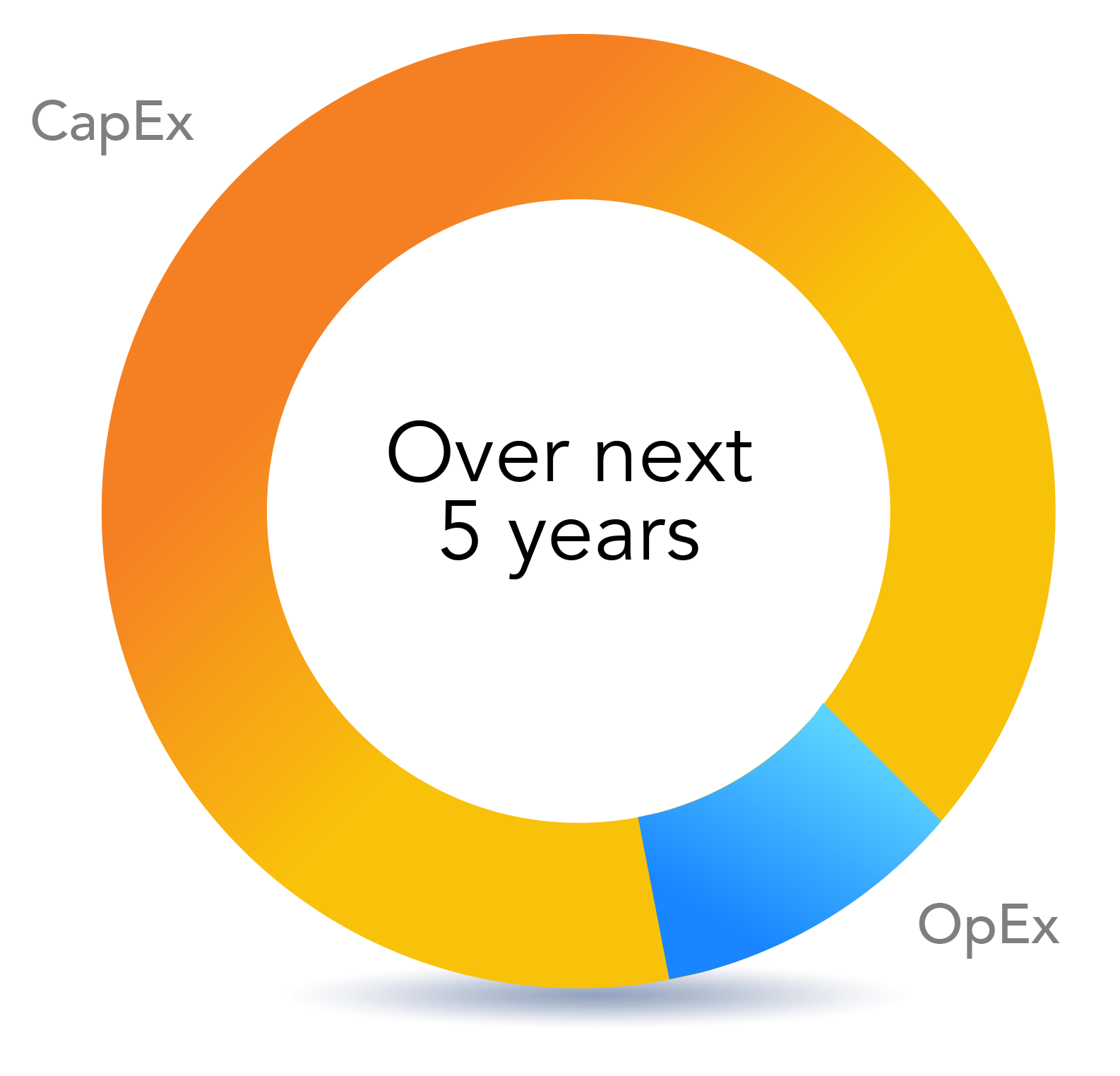

$2B Investment to Drive Customer Value and Expand Margins

Modernizing infrastructure, growing talent, and enhancing digital capabilities

- Efficiency in existing and new plants

- New brick and mortar in the US

- AI-native talent: data science & cybersecurity

- Customer-facing resources to fuel growth

- Secure, intelligent operations at the edge

- AI-first IT infrastructure

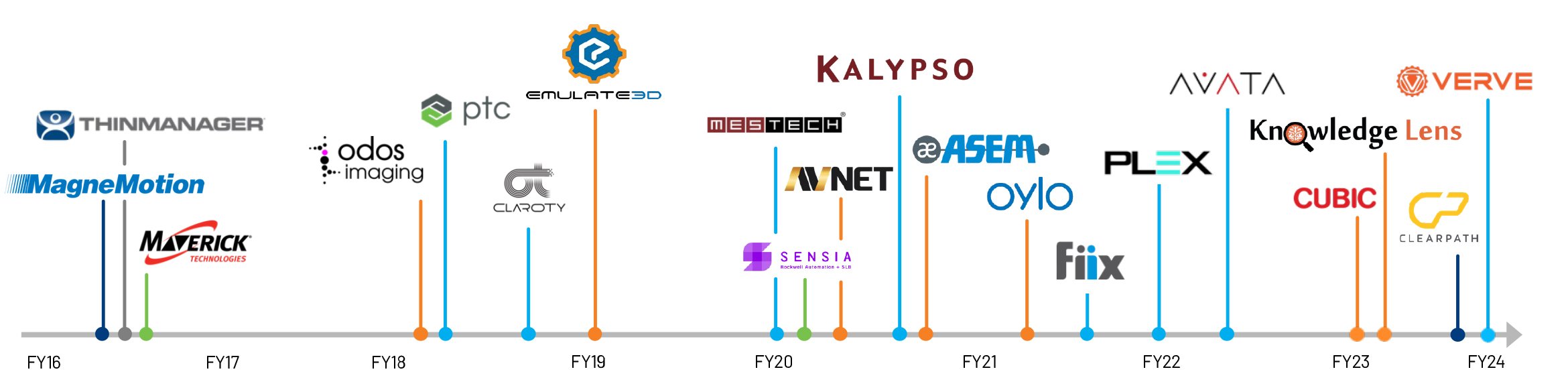

Inorganic Investments

Introduced in 2025

Inorganic

priorities

Industrial AI Applications

Market Access in Europe / Asia

Product Portfolio Expansion

Prior inorganic

priorities

Process Expertise

Information Solutions / Connected Services

Market Access in Europe / Asia

Advanced Material Handling

Capital Deployment

Our strong balance sheet provides us with significant flexibility and capacity to deploy capital. Our capital deployment priorities have not changed: make investments to fund organic growth, drive a point or more per year of growth from strategic acquisitions, and return excess cash to shareowners through dividends and share repurchases.

ORGANIC INVESTMENTS

Operating Cash Flow

Capital Expenditures

~2.5 to 4% of Sales

Free Cash Flow

~100% of Adjusted Income

INORGANIC INVESTMENTS

Acquisitions

Target ~1 pt of growth per year

EXCESS CASH RETURNED TO SHAREOWNERS

Dividends

Maintain “A” credit rating

Share Repurchases

Framework for Continued Superior Financial Returns

Our longer-term framework for financial performance starts with organic sales growth, which drives earnings conversion (incremental margins). Free cash flow conversion of 100% or more and a strong balance sheet provide significant capacity for strategic capital deployment, including acquisitions and share repurchases. As a result, we expect EPS growth to outpace revenue growth and ROIC to remain over 20%.