Southeast Asia’s manufacturing sector had a challenging start to 2025, but a positive end. As the uncertainty settles, 2026 presents an opportunity to move forward with intelligence, foresight and the ability to scale digital capabilities across diverse markets. As global supply chains continue to rebalance and the region strengthens its position in electronics, automotive, food production and advanced materials, manufacturers are asking a new question: How do we build operations that can anticipate, not just react?

Four forces will shape this next chapter: predictive capability, edge intelligence, workforce evolution and embedded sustainability. Underpinning these forces is the accelerating use of AI across Southeast Asia’s manufacturing sector, not as a standalone lever but an enabler for smarter decisions, faster responses and more adaptable operations.

Together, these shifts reflect a broader regional movement toward adaptive, insight-driven manufacturing. While countries such as Singapore and Malaysia offer early examples, the implications span the entire Southeast Asian landscape.

Predictive manufacturing becomes a regional differentiator

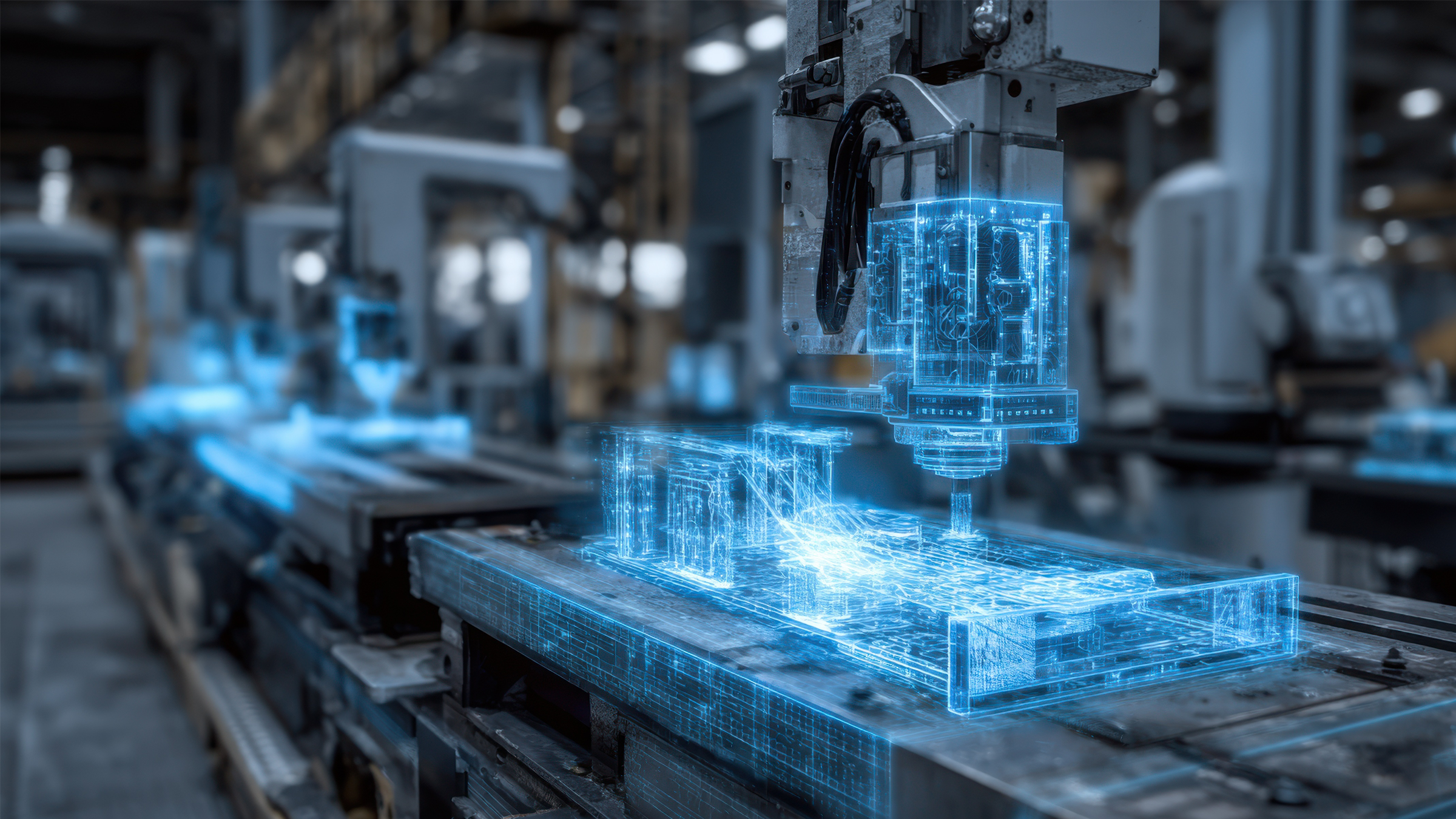

Predictive manufacturing is fast becoming the region’s competitive advantage. Manufacturers across ASEAN are accelerating their use of digital twins, simulation environments and AI-enabled forecasting to anticipate issues before they occur.

Several factors are driving this shift:

- Rising pressure to maintain quality across expanding multi-site networks

- Tighter production tolerances in sectors like semiconductors and advanced materials

- Operational cost increases that demand more efficient resource use

Rockwell Automation’s 10th Annual State of Smart Manufacturing Report highlights that 94% of APAC manufacturers are investing in or planning adoption of AI/ML tools. Predictive technologies are at the center of these investments, reflecting a global shift from manual troubleshooting to data-driven optimization.

Research reinforces this momentum, wherein predictive maintenance practices in 2025 shows consistent reductions in downtime, energy use and maintenance costs across digitally advanced plants.

Early movers across Southeast Asia are already applying predictive insights to optimize equipment lifecycles, balance energy loads and simulate production decisions before making physical adjustments. This capability allows manufacturers to navigate uncertainty with greater confidence, an advantage that will grow more critical as supply chains adjust across the region.

Edge intelligence accelerates smart manufacturing at scale

While cloud platforms remain essential for enterprise-wide governance and analytics, the next wave of industrial gains in Southeast Asia will be unlocked at the edge. Edge intelligence enables data to be processed directly on the production floor, supporting faster, more accurate decisions.

IDC’s Asia/Pacific Future of Operations Survey estimates that 40% of operational data in the region will be generated and processed at the edge by 2027. This reflects the realities of Southeast Asian manufacturing: distributed production networks, varying connectivity environments, and a mix of advanced and legacy equipment.

Edge analytics is particularly effective for:

- Latency-sensitive tasks such as quality checks and anomaly detection, many of which rely on lightweight AI models deployed directly

- Reducing cloud dependency and data-transfer costs

- Sustaining operational continuity in geographically dispersed plants

Manufacturers are increasingly using a blended approach, where big picture analysis happens in the cloud while fast, real-time decisions happen at the factory. This hybrid architecture is becoming a norm in markets such as Vietnam, Thailand, Malaysia and Indonesia to modernize at their own pace while maintaining unified oversight.

For enterprise IT leaders, this signals a strategic shift: edge is no longer a hardware consideration but a foundational element of digital resilience.

People will define the success of digital factories

Despite rapid advances in automation and AI, human capability remains central to manufacturing competitiveness. A recurring challenge across ASEAN is workforce readiness: senior technicians are retiring, younger talent is gravitating toward digital-first industries, and new technologies require new skills.

But across the region, manufacturers are reframing workforce transformation from a labor shortage problem into a skills-acceleration opportunity.

Three developments are gaining traction:

- Augmented work instructions: AI-driven guidance embedded into operations helps technicians perform complex tasks accurately, reducing onboarding time and error rates.

- Hybrid job roles: Traditional operators and maintenance staff are evolving into reliability engineers and data-informed decision makers, roles that combine domain expertise with digital fluency.

- Continuous on-the-job learning: Organisations are adopting digital training modules that integrate directly into workflows. Such approaches are essential for Asia’s next-stage industrial growth

The latest Rockwell State of Smart Manufacturing Report indicates that 42% of Asia Pacific manufacturers are using digital tools to redesign roles and create more engaging work environments. This underscores the region’s broader pivot toward workforce augmentation, not replacement.

Sustainability becomes an operational lever, not a reporting task

Southeast Asian manufacturers are increasingly integrating sustainability into production, moving beyond compliance into real-time operational optimization. AI-enabled energy orchestration, automated load balancing and waste-reduction analytics are allowing factories to reduce consumption while maintaining throughput.

As customers tighten expectations around transparency, sustainability performance is increasingly intertwined with competitiveness. The manufacturers that treat sustainability as a measurable, data-driven performance metric will lead the next phase of regional growth.

A predictive, connected and people-centred future

Southeast Asia’s manufacturing sector will continue to diversify in 2026, but one theme will cut across all markets: intelligence will define advantage. Predictive tools will shape strategic decisions, edge intelligence will enable responsiveness at scale, workforce transformation will become a shared priority, and sustainability will integrate into daily operations.

For manufacturing leaders across the region, the goal is not to adopt every emerging technology, but to build digital foundations that connect systems, empower people and deliver insights that scale across varied environments. Those who do will navigate the region’s rapid transformation and shape its next era.

Originally published on Enterprise IT News